2025/2026 Walvis Bay Budget

- JWBRA Team

- May 21, 2025

- 12 min read

Updated: Sep 9, 2025

Disclaimer: This post is an independent analysis based on the documents the Municipality shared at their special Council Meeting on 16 May 2025. Every effort has been made to present accurate and fair insights, but figures and interpretations may change as new information becomes available or if the budget is updated. This content is meant to inform and educate residents, not to replace official communication and financial reports from the Municipality of Walvis Bay. Residents are encouraged to consult official sources and participate in the budget process.

Table of Contents

What is a Municipal Budget and Why Does it Matter?

How the Walvis Bay Budget is Created: Step-by-Step

Who Decides Where the Money Goes?

Breaking Down the 2025/2026 Walvis Bay Budget

Walvis Bay 2026 Budget Details

Revenue vs. Spending: Where Does the Money Come From?

Budget Priorities: What Do They Say About Our Town?

Public Participation in the Budget Process

A big part of the Walvis Bay Municipality is the the annual budget. This financial estimate details what money is spent where. Obviously, a budget can make or break a town's progress. If money is spent on the wrong projects or wasted on unnecessary things, no money is left for the things that count. (Article continues below the video)

What is a Municipal Budget and Why Does It Matter?

A municipal budget is an estimate of income and expenses for the next financial year. Each Local Authority needs to have one, whether they are a city, town or village. Find out what else Council needs to do.

The budget includes revenue (money coming in) and expenditure (money being spent). Local Authorities get money from rates and taxes, service fees like water and refuse charges and grants or loans. They spend money on services like water, sewage and refuse. They also have to pay for operating expenses (like salaries and fleet maintenance), as well as capital expenses (big purchases like machinery or other investments).

A town needs money to run properly, and municipalities are not allowed to spend any money not budgeted for. The budget shows what is important to the town's leadership. If the priorities are wrong, no money is available for important upgrades or projects. This directly affects quality of life for the residents.

It is really important that residents know about the budget so you know what happens to the money you pay for services in Walvis Bay. In this article, we'll explain how budgets are created in general, what the 2025/2026 budget means for Walvis Bay and what you can do about it.

To make things easier to understand, we will use the term "budget" to mean and include estimates of both operating and capital income and expenses, unless otherwise specified.

How the Walvis Bay Budget is Created: Step-by-Step

Each year, the Local Authority must prepare an estimate of their income and expenditure for the following financial year. This gets submitted to the Minister of Regional and Local Government, Housing and Rural Development, who may approve it with or without conditions.

This process is governed by the Local Authorities Act, 1992 (Act No. 23 of 1992) as amended. The municipality of Walvis Bay gazetted Financial Rules in 1997 that prescribe their internal process.

It's important to note that a municipality's budget may not be in a deficit (that is, the Council cannot spend more money than the town makes).

Step 1: Department Estimates

Leading up to the month of May, each Head of Department in the Municipality must work with the Town Treasurer to compile the following:

Revised financial statements for the current year,

A draft budget for the upcoming year, and

A draft programme for capital projects for the following two years.

The Town Treasurer collaborates with the Head of Departments and Town Clerk to refine, organise and amend the individual draft estimates. The consolidated estimates are submitted to the Management Committee by the Town Clerk.

The Town Clerk also submits to the Management Committee details of capital projects that need to be financed. This can only be done during the month of March.

Step 2: Council Approval

The Management Committee must present the draft estimates to Council before or during the first ordinary Council meeting during the month of May. The presentation has to include recommendations about levies and fees, and any other relevant comments.

The Town Council can only approve the budget after consultation with the Regional Council, and has to keep evidence of this consultation.

Step 3: Minister Approval

Once Council has consulted with the Regional Council and approved the draft estimates, they need to prepare a budget pack to send to the line ministry (in this case, the Ministry of Regional and Local Government, Housing and Rural Development - previously the Ministry of Urban and Rural Development).

This budget pack normally includes

The budget in a prescribed format, which shows

The sources revenue and expected income for each,

Projects and programmes with the expected expenses for each,

Evidence of the consultations with the Regional Council,

New tariff structures with

Existing and new tariffs with the increase shown as a percentage and

Council's approval thereof,

The latest bank statements of the Municipality,

Additionally, the budget needs to be balanced (numbers in the summary should reflect the actual amounts) and there must not be a deficit (Council cannot plan to spend more money than they take in).

The Minister specifies a date by which the budget must be submitted so that it can be approved in time for the new financial year. A Local Authority Council financial year ends on 30 June.

Who Decides Where the Money Goes?

Many people and bodies are involved in the making of a budget. From the municipality employees, to Council, the Ministry and the public - creating budget is a complex project that should receive due attention and diligence.

Municipal Heads of Department

The Financial Rules give the Heads of Departments in Walvis Bay's Municipality a lot of power and responsibility. Their annual financial reports and estimates make up most the municipal budget.

The Heads of Departments base their financial planning on current numbers, projected needs for the next 1-2 years and input from the Town Treasurer. They are not supposed to work in a deficit. If their budget overspends, they should submit a plan to come up with the missing funds.

Walvis Bay's Financial Rules require the Heads of Departments to create and maintain internal controls so that operations are efficient and well-ordered. They must keep track of stock and inventory, only acquire what is needed and keep the Treasurer informed of the status of capital assets. The Heads of Department are supposed to conduct their financial activities and planning with transparency and efficiency.

Basically, the Heads of Department let the Town Clerk and Treasurer know what they need money for. They actively shape the budget - without their input, Council would have no idea what to spend money on.

Town Clerk and Town Treasurer

Unless otherwise arranged, the CEO is also the accounting officer for the Local Authority Council and responsible for all money received and spent.

According to Walvis Bay's Financial Rules, the Town Treasurer can issue guidelines that limit any spending. Both the Treasurer and Clerk are actively involved in refining and amending the draft estimates from the Heads of Department. They also compile the final, consolidated version that is given to the Management Committee.

While they may not actively decide what goes into the budget, they can influence and direct the Heads of Departments on what should be included. Depending on how they present the budget to the Management Committee, they can also highlight projects they think are important.

The Management Committee

The Management Committee handles the daily affairs and management of the Local Authority, supporting and advising Council. In terms of the budget, the Management Committee's role is to review and consolidate the draft estimate and any other capital projects. They then present the budget to Council for approval and later, control the spending for the approved expenditures.x

Since the Management Committee is required to comment on the proposed budget, they can significantly influence how it is presented to Council. Their comments may cause individual councillors to vote for or against the budget.

The Local Authority Council

Council has the final say on the municipal budget before it gets sent to the Ministry. The Local Authorities Act clearly lays out how Council has to make decisions, and the councillors are allowed to approve, amend or reject the draft estimates. This is done by majority vote if a quorum (majority of councillors) is present.

Since Walvis Bay Council has ten seats, a single councillor's vote against the budget will not change the outcome. While Council as a whole has the ultimate power, the Councillors themselves can only influence the budget if they're part of the Management Committee or form a majority in the vote.

The Line Ministry

The current Ministry of Regional and Local Government, Housing and Rural Development oversees Local Authority Councils. Council has to submit their budget to the Minister in time for it to be approved for the next financial year.

The Minister issues guidelines and directives for how the budget should be compiled and submitted. They can approve the estimates with or without conditions, or require Council to amend them.

In short, the Minister has to make sure that Councils follow the correct procedures and apply due diligence in their planning. Without their say-so, nothing works. If the approval is delayed, Council does have the power to spend money (limited to a percentage of the previous year's estimates) on essential projects but only for three months.

The Residents of Walvis Bay

Since members of the public cannot vote in Council meetings, residents have to influence the budget in other ways.

They can provide input and concerns during public meetings. Council is required to hold at least three of these per year. While the agenda is predetermined and may not include the budget or spending, you can inform Council that you want to discuss another matter, by written notice at least 7 days before the meeting.

They can stay informed. By attending Council meetings, requesting copies of the minutes and following the Municipality and groups like the JWBRA on social media, you will have a better idea of what's going on and can raise concerns well ahead of time.

They can contact their councillors and make them aware of concerns or questions. Each registered party or association has ways for you to get in touch with their local representatives. If you want to share your thoughts with the JWBRA Councillor, simply send us an email or fill out the contact form.

They can vote. Voting lets you actively shape who sits on the council. When you vote for people who share your interests and concerns, they have a better chance of becoming a councillor. And councillors, as we have shown, have the last say in the municipal budget.

Breaking Down the 2025/2026 Walvis Bay Budget

A budget consists of operating and capital expenses. The operating budget covers running costs like salaries, while the capital budget details large purchases like vehicles.

The 2025/2026 combined budget is N$1.3 billion, with the final expenses being nearly equally split between operating and capital.

As with all budgets, there are some adjustments made at the financial year-end. Taking those out changes the budget composition slightly.

Walvis Bay 2026 Budget Details

43% of the capital budget is allocated for land developments, most of these residential. Another large portion of capital expenses will go towards infrastructure repair and replacement. Other purchases include refuse removal trucks and construction vehicles.

Salary costs have increased by 19% from the last budget (that's a whopping N$60 million). Additionally, Council has acknowledged "operational challenges" and plans to purchase five new refuse trucks. Incidentally, these plans were carried over from the 2024/2025 budget.

While the motivations for capital expenses show that a lot of minor equipment (like chairs or microwaves) does seem to be in need of replacement, there are also items like fleet vehicles that may not be necessary at the moment.

The budget is praised by the media for "driving development" and addressing urgent needs, but a few concerns linger. Walvis Bay has never spent more than 20% of its budget in the last 10 years. This could be seen as sound financial management and cost-cutting efforts. However, the state of the town (from failing sewerage infrastructure and dilapidated roads right down to broken library chairs) says otherwise.

Revenue vs. Spending: Where Does the Money Come From?

The Local Authority generally makes its money from service charges like water, as well as penalties, permits, rentals and other miscellaneous activities.

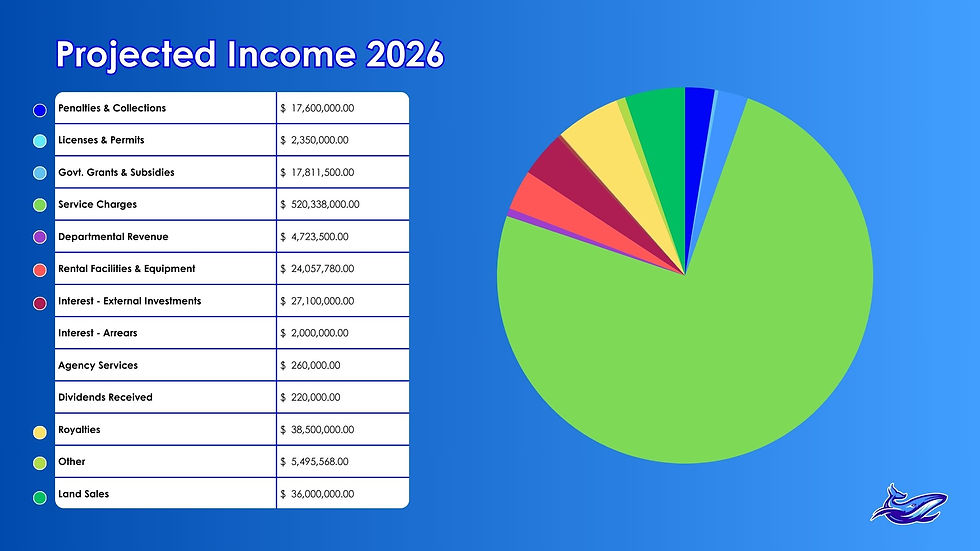

The 2025/2026 Budget estimates an operating income that exactly equals the expenses (N$660,456,348). Three quarters of this income is generated by service charges, such as water and refuse bills. New to this section is the item "Illegal Temporary Structures", which should bring in a good N$33 million in fines next year. Other big money makers are rentals, royalties, penalties and land sales.

While the operating budget appears balanced on paper, the reality is not so good. By the time the estimates were published on 16 May 2025, Council had only brought in 65% of last year's budgeted income. While they also have not yet spent the estimated expenses for 2024/2025, the year-to-date numbers show a N$26 million deficit.

We must therefore question how realistic the new budget is. Will Council have enough money to cover their expenses in 2026?

Budget Priorities: What Do They Say About Our Town?

The budget speech highlighted Council's "unwavering commitment" to, amongst others, the quality of life of its residents. Big amounts are allocated to critically needed repairs and maintenance. Yet by May 2025, Council had used less than half of last year's maintenance budget. It is no wonder that so many things are run down, and it makes one wonder if the new budget is achievable.

It's also important to note that salary costs have increased by 19% from last year (that's over N$60 million), with N$13 million reserved for bonuses. The performance management system approved in 2023 is still not in place, so there is no way to incentivise good work ethic in the Municipality. Currently, staff are getting annual increases by default.

In the capital budget, some interesting plans are a website overhaul and mobile app, besides the investments in infrastructure and refuse trucks.

While much of the 2024/2025 budget has been underspent (and according to Councillor Ronald "Buddy" Bramwell of the JWBRA, this has been the case for ten years now), the salary budget was always maxed out fully.

Public Participation in the Budget Process

The budget directly affects Walvis Bay residents. Service tariffs have gone up by 3% - less than inflation but still noticeable on your monthly bill. There is some hope for roads and housing, but the investments may not be as much as is needed for urgent improvement.

Who Benefits From This Budget?

Capital projects favour roads, administration and fleet replacement. Not all vehicles on the budget seem actually necessary. Money allocated for the replacement of chairs, upgrading of PA systems and other maintenance tasks is long overdue - one has to ask, why was it left this long?

The focus here is clearly on the municipality. Our roads haven't been resurfaced in years and were broken long before the rain came. The investments planned for land development, sewerage upgrades and roads may seem like a lot of money but will they really be implemented?

The repairs and maintenance portion of the operating budget shows the trends the JWBRA Councillor warned against. Over N$3 million on general building maintenance were budgeted for 2025, and just under N$700,000 spent by the end of April. Yet for 2026, the estimate has been doubled.

If one takes the time to read through the motivations for capital projects, it quickly becomes clear that departments are requesting large amounts for office space and equipment rather than frontline service expansion. When that happens, a lot of money goes to internal needs (like microwaves and chairs or vehicles and IT systems). These can make things more efficient but don't really impact the public's life.

Are We Expanding Services or Just Offices?

Not all capital spending benefits residents equally. Both frontline services and internal operations are important, but the balance tells us a lot about municipal priorities.

Services (N$65.5 million) | Administrative (N$32.5 million) |

Electricity Network: N$10 million | Fleet Replacement: N$9 million |

Water Network: N$12.5 million | Office Equipment: N$8.5 million |

Sewerage: N$18 million | Municipal Buildings: N$15 million |

Roads: N$25 million |

While the budget overall seems to favour services, every dollar spent on offices is one dollar less for roads, sewers and parks. Residents must ask if the current balance meets public needs - especially when it comes to informal areas and underserved communities.

What You Can Do: Holding the Municipality Accountable

This budget is your money. The biggest income generator for the Municipality are service charges - money the residents pay for water, sewerage and so forth. A municipality exists to serve its residents and it's important that we demand clarity and transparency about where our money goes.

How do you feel about the budget?

It looks great!

I don't really understand it.

It worries me.

Here are some ways that you can hold the Municipality accountable:

Track Capital Projects

Keep an eye on Council minutes, newspaper reports and updates by the Municipality itself. Especially where projects take multiple years, it's crucial to stay up to date with progress so that you can question delays.

For example, take a look at this comparison of capital budgets and actual money spent.

Demand Clearer Data

Push for summaries, explanations and graphs to visualise the budget at public meetings. Ask for updates on budget reviews and performance audits to see if the funds are being used properly.

Attend Council Meetings

Most Council meetings are open to the public. By attending, you not only show the Councillors that you actively care. You also stay informed and can make noise about potential issues quickly.

Use Your Councillors

Share your questions and concerns with your Councillors. Ask them to request important information or explain how certain things work. Engage with them to table motions for actual change and provide feedback to their constituents.

Why Understanding the Budget Empowers You

You cannot ignore the budget. It's not just about numbers - it's about who gets services, who gets sidelined and who benefits from the public's money.

If you don't speak up, decisions are made about you, without you.

Over the last 5 financial years the average % of the capital budget actually spent was only 12%. Does the municipality have a resource problem ( equipment/ human expertise ) or is it merely an optimistic, unachievable capital budget presented to Council ?

A salary-increase of 19% over the previous year is also not in line with salary-increases in

the private sector.